How to Delete Financial Accounting Course. save (45.24 MB)

Published by Thu NguyenWe have made it super easy to delete Financial Accounting Course account and/or app.

Table of Contents:

Guide to Delete Financial Accounting Course 👇

Things to note before removing Financial Accounting Course:

- The developer of Financial Accounting Course is Thu Nguyen and all inquiries must go to them.

- The GDPR gives EU and UK residents a "right to erasure" meaning that you can request app developers like Thu Nguyen to delete all your data it holds. Thu Nguyen must comply within 1 month.

- The CCPA lets American residents request that Thu Nguyen deletes your data or risk incurring a fine (upto $7,500 dollars).

↪️ Steps to delete Financial Accounting Course account:

1: Visit the Financial Accounting Course website directly Here →

2: Contact Financial Accounting Course Support/ Customer Service:

- 84.38% Contact Match

- Developer: Advanced Educational Technology Inc

- E-Mail: flashcardinc@gmail.com

- Website: Visit Financial Accounting Course Website

Deleting from Smartphone 📱

Delete on iPhone:

- On your homescreen, Tap and hold Financial Accounting Course until it starts shaking.

- Once it starts to shake, you'll see an X Mark at the top of the app icon.

- Click on that X to delete the Financial Accounting Course app.

Delete on Android:

- Open your GooglePlay app and goto the menu.

- Click "My Apps and Games" » then "Installed".

- Choose Financial Accounting Course, » then click "Uninstall".

Have a Problem with Financial Accounting Course? Report Issue

🎌 About Financial Accounting Course

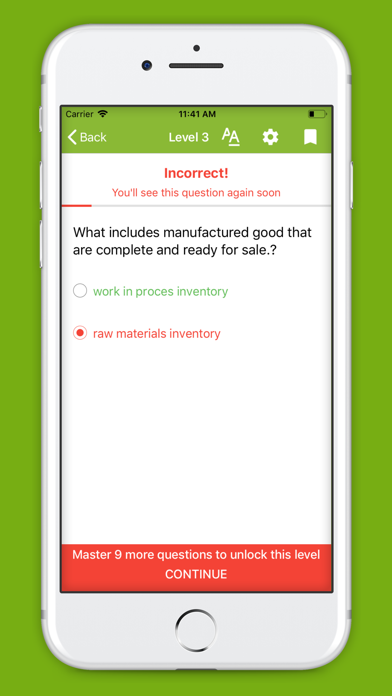

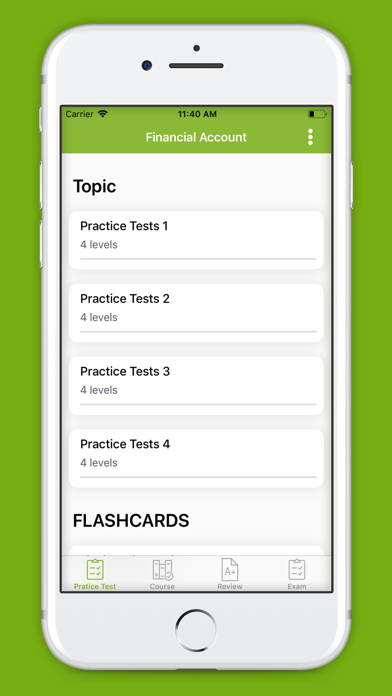

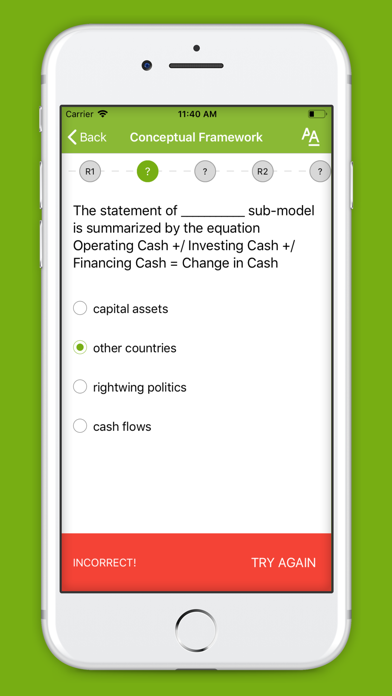

1. This app contains thousands of real exam questions for self learning & exam preparation on the topic of Financial Accounting, IFRS & GAAP.

2. Because external financial statements are used by a variety of people in a variety of ways, financial accounting has common rules known as accounting standards and as generally accepted accounting principles (GAAP).

3. Financial Accounting Exam prep uses proven study and test-taking strategies so that you’ll feel confident and ready to go when you have to take the Financial Accounting Exam.

4. If a corporation's stock is publicly traded, however, its financial statements (and other financial reportings) tend to be widely circulated, and information will likely reach secondary recipients such as competitors, customers, employees, labor organizations, and investment analysts.

5. It's important to point out that the purpose of financial accounting is not to report the value of a company.

6. Financial accounting is a specialized branch of accounting that keeps track of a company's financial transactions.

7. In the U.S., the Financial Accounting Standards Board (FASB) is the organization that develops the accounting standards and principles.

8. Using standardized guidelines, the transactions are recorded, summarized, and presented in a financial report or financial statement such as an income statement or a balance sheet.

9. Companies issue financial statements on a routine schedule.

10. The statements are considered external because they are given to people outside of the company, with the primary recipients being owners/stockholders, as well as certain lenders.

11. With our Advanced Smart Learning Technology, you can master the learning materials quickly by studying, practicing and playing at lunch, between classes or while waiting in line.

12. +) Learning materials are prepared by EXPERTS in this field for the most current exam.

13. Corporations whose stock is publicly traded must also comply with the reporting requirements of the Securities and Exchange Commission (SEC), an agency of the U.S. government.

14. Rather, its purpose is to provide enough information for others to assess the value of a company for themselves.