How to Delete Chase. save (59.64 MB)

Published by JPMorgan Chase & Co.We have made it super easy to delete Chase Mobile Checkout Plus account and/or app.

Table of Contents:

Guide to Delete Chase Mobile Checkout Plus 👇

Things to note before removing Chase:

- The developer of Chase is JPMorgan Chase & Co. and all inquiries must go to them.

- The GDPR gives EU and UK residents a "right to erasure" meaning that you can request app developers like JPMorgan Chase & Co. to delete all your data it holds. JPMorgan Chase & Co. must comply within 1 month.

- The CCPA lets American residents request that JPMorgan Chase & Co. deletes your data or risk incurring a fine (upto $7,500 dollars).

↪️ Steps to delete Chase account:

1: Visit the Chase website directly Here →

2: Contact Chase Support/ Customer Service:

- 100% Contact Match

- Developer: JPMorgan Chase

- E-Mail: mobilepos.feedback@chase.com

- Website: Visit Chase Website

Deleting from Smartphone 📱

Delete on iPhone:

- On your homescreen, Tap and hold Chase Mobile Checkout Plus until it starts shaking.

- Once it starts to shake, you'll see an X Mark at the top of the app icon.

- Click on that X to delete the Chase Mobile Checkout Plus app.

Delete on Android:

- Open your GooglePlay app and goto the menu.

- Click "My Apps and Games" » then "Installed".

- Choose Chase Mobile Checkout Plus, » then click "Uninstall".

Have a Problem with Chase Mobile Checkout Plus? Report Issue

🎌 About Chase Mobile Checkout Plus

1. Chase Mobile Checkout–PLUS allows you to accept credit and debit card payments with your smartphone or tablet wherever your business takes you in Canada.

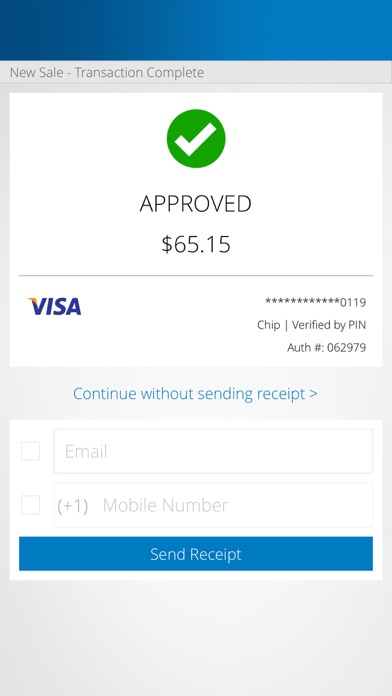

2. • Simplify your daily business activities by searching for specific transactions, viewing reports, processing voids/refunds and keeping up with your merchant account – all from your smartphone or tablet.

3. • Enhance your customers' experience by accepting all major CHIP and PIN contact and contactless credit cards and Interac debit cards on the go.

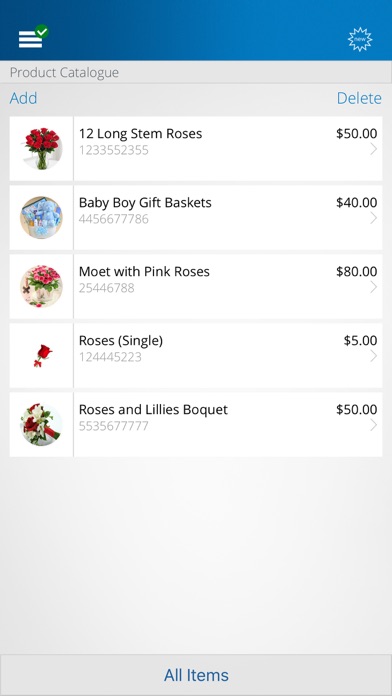

4. • Streamline the checkout process with an image-based catalog that allows you to select the right product or service every time.

5. • Available with end-to-end encryption and tokenization technology, at no additional cost to you, to help secure cardholder data.