Cancel Square Payroll Subscription

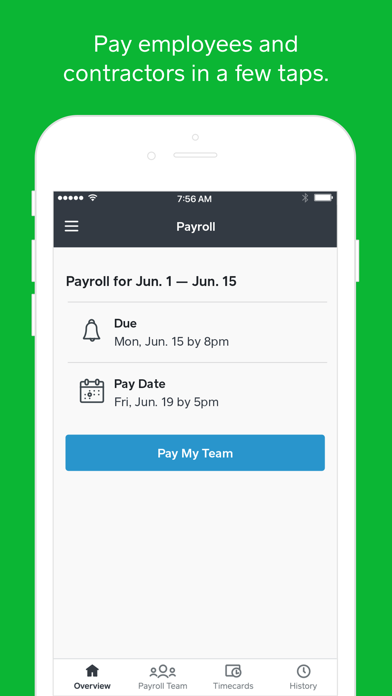

Published by Square, Inc.Uncover the ways Square, Inc. (the company) bills you and cancel your Square Payroll subscription.

🚨 Guide to Canceling Square Payroll 👇

Note before cancelling:

- The developer of Square Payroll is Square, Inc. and all inquiries go to them.

- Always cancel subscription 24 hours before it ends.

🌐 Cancel directly via Square Payroll

- 🌍 Contact Square Payroll Support

- Mail Square Payroll requesting that they cancel your account:

- E-Mail: help@help-messaging.squareup.com

- Login to your Square Payroll account.

- In the menu section, look for any of these: "Billing", "Subscription", "Payment", "Manage account", "Settings".

- Click the link, then follow the prompts to cancel your subscription.

End Square Payroll subscription on iPhone/iPad:

- Goto Settings » ~Your name~ » "Subscriptions".

- Click Square Payroll (subscription) » Cancel

Cancel subscription on Android:

- Goto Google PlayStore » Menu » "Subscriptions"

- Click on Square Payroll

- Click "Cancel Subscription".

💳 Cancel Square Payroll on Paypal:

- Goto Paypal.com .

- Click "Settings" » "Payments" » "Manage Automatic Payments" (in Automatic Payments dashboard).

- You'll see a list of merchants you've subscribed to.

- Click on "Square Payroll" or "Square, Inc." to cancel.

Subscription Costs (Saved) 💰

Square Payroll

- Pricing: Starts at $40 per month

- Features:

- Pay W2 employees and 1099 contractors

- Direct deposit, check, or deposit to Cash App or Cash Cards

- Unlimited payruns each month

- Handles all payroll tax filings and payments

- Provides quarterly and end of year reports

- Import timecard hours and tips

- Track sick leave, paid time off, and overtime

- Manage pre- and post-tax deductions

- Let team members set up online accounts

- Set up Automatic Payroll

- Access affordable benefits plans

- Additional pricing information:

- No monthly subscription for paying 1099 contractors, just $5 per contractor per month

- Availability: All 50 states + DC

- Learn more: squareup.com/payroll

Have a Problem with Square Payroll? Report Issue

About Square Payroll?

1. Use the app to import timecards or enter your team’s hours, then let our team of specialists take care of the rest—we pay your team, file your payroll taxes, and send your tax payments to federal and state tax agencies.

2. There’s no monthly subscription if you’re just paying 1099 contractors - it’s just $5 per contractor you pay each month.

3. Whether you’re paying your first employee or switching from another provider, we’re here to make payroll the easiest thing on your to do list.

4. Access affordable full-service payroll, built by Square.

5. Your team gets paid via direct deposit, check, or deposit to the Cash App or Cash Cards.