Cancel Tinkoff Subscription

Published by Tinkoff BankUncover the ways Tinkoff Bank (the company) bills you and cancel your Tinkoff subscription.

🚨 Guide to Canceling Tinkoff 👇

Note before cancelling:

- The developer of Tinkoff is Tinkoff Bank and all inquiries go to them.

- Check Tinkoff Bank's Terms of Services/Privacy policy if they support self-serve cancellation:

- Always cancel subscription 24 hours before it ends.

🌐 Cancel directly via Tinkoff

- 🌍 Contact Tinkoff Support

- Mail Tinkoff requesting that they cancel your account:

- E-Mail: support@tinkoff.ru

- Login to your Tinkoff account.

- In the menu section, look for any of these: "Billing", "Subscription", "Payment", "Manage account", "Settings".

- Click the link, then follow the prompts to cancel your subscription.

End Tinkoff subscription on iPhone/iPad:

- Goto Settings » ~Your name~ » "Subscriptions".

- Click Tinkoff (subscription) » Cancel

Cancel subscription on Android:

- Goto Google PlayStore » Menu » "Subscriptions"

- Click on Tinkoff

- Click "Cancel Subscription".

💳 Cancel Tinkoff on Paypal:

- Goto Paypal.com .

- Click "Settings" » "Payments" » "Manage Automatic Payments" (in Automatic Payments dashboard).

- You'll see a list of merchants you've subscribed to.

- Click on "Tinkoff" or "Tinkoff Bank" to cancel.

Subscription Costs (Saved) 💰

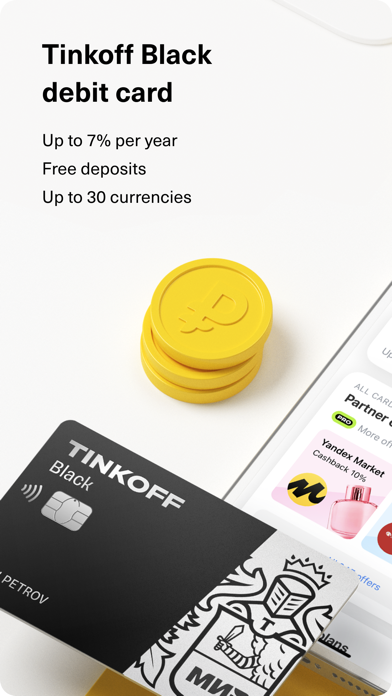

Tinkoff Black tariff: includes additional benefits such as higher cashback rates, free withdrawals from any ATM in Russia, and free transfers to any bank in Russia.

- The Tinkoff Black tariff costs 1,990 rubles per month.

- Additionally, the app offers credit cards with interest-free installment plans, with interest rates starting from 29.9% and credit limits of up to 300,000 rubles.

Have a Problem with Tinkoff? Report Issue

About Tinkoff?

1. Going beyond mobile banking, the Tinkoff app offers its users services galore, be it about movies, concerts, theatres, travel, restaurants, shopping, health, or beauty parlours.

2. Best mobile bank app in Central and Eastern Europe in 2018, according to Global Finance.

3. Russia’s best mobile bank app in 2013–2018 (as recognised by Deloitte and Markswebb Rank & Report).

4. ∙ Pay your mobile phone, Internet and utility bills, fines, fees for government services, etc.

5. ∙ Stories: information about money and events, selection of movies, reviews of articles, tips for travellers, etc.