Cancel indi Subscription & Save $100.00

Published by numo LLCUncover the ways numo LLC (the company) bills you and cancel your indi subscription.

🚨 Guide to Canceling indi 👇

Note before cancelling:

- How easy is it to cancel indi? It is Difficult to Cancel a indi subscription.

- The developer of indi is numo LLC and all inquiries go to them.

- Always cancel subscription 24 hours before it ends.

Your Potential Savings 💸

**Pricing data is based on average subscription prices reported by AppCutter.com users..

| Duration | Amount (USD) |

|---|---|

| One-time savings | $100.00 |

🌐 Cancel directly via indi

- 🌍 Contact indi Support

- Mail indi requesting that they cancel your account:

- E-Mail: support@goindi.com

- Login to your indi account.

- In the menu section, look for any of these: "Billing", "Subscription", "Payment", "Manage account", "Settings".

- Click the link, then follow the prompts to cancel your subscription.

End indi subscription on iPhone/iPad:

- Goto Settings » ~Your name~ » "Subscriptions".

- Click indi (subscription) » Cancel

Cancel subscription on Android:

- Goto Google PlayStore » Menu » "Subscriptions"

- Click on indi – Smart Banking

- Click "Cancel Subscription".

💳 Cancel indi on Paypal:

- Goto Paypal.com .

- Click "Settings" » "Payments" » "Manage Automatic Payments" (in Automatic Payments dashboard).

- You'll see a list of merchants you've subscribed to.

- Click on "indi" or "numo LLC" to cancel.

Have a Problem with indi – Smart Banking? Report Issue

About indi – Smart Banking?

1. The indi prepaid debit card is issued by PNC Bank, National Association.

2. indi's Tax Savings Goal feature is not a substitute for individual tax planning or for legal, financial, or tax advice.

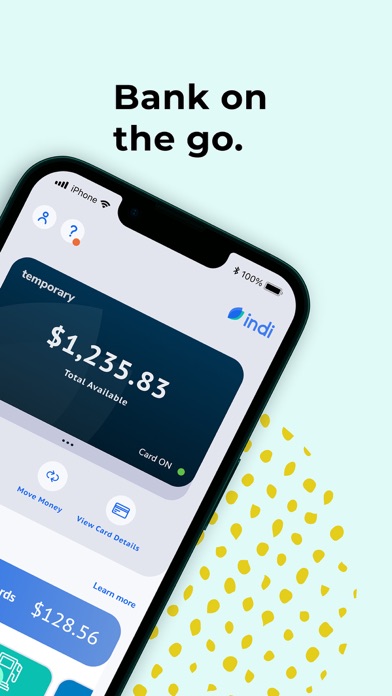

3. Use indi to bank smarter, save for taxes, and maximize expense deductions—all in one account, right in your pocket.

4. indi is a registered mark of numo llc, a subsidiary of The PNC Financial Services Group, Inc.

5. indi is an FDIC-insured account² with a debit card³ and mobile banking app built for independent workers.