How to Delete Small Loans. save (51.21 MB)

Published by FOCUS FINANCIAL MANAGEMENT LIMITEDWe have made it super easy to delete Small Loans for Bad Credit FFM account and/or app.

Table of Contents:

Guide to Delete Small Loans for Bad Credit FFM 👇

Things to note before removing Small Loans:

- The developer of Small Loans is FOCUS FINANCIAL MANAGEMENT LIMITED and all inquiries must go to them.

- The GDPR gives EU and UK residents a "right to erasure" meaning that you can request app developers like FOCUS FINANCIAL MANAGEMENT LIMITED to delete all your data it holds. FOCUS FINANCIAL MANAGEMENT LIMITED must comply within 1 month.

- The CCPA lets American residents request that FOCUS FINANCIAL MANAGEMENT LIMITED deletes your data or risk incurring a fine (upto $7,500 dollars).

↪️ Steps to delete Small Loans account:

1: Visit the Small Loans website directly Here →

2: Contact Small Loans Support/ Customer Service:

- 66.67% Contact Match

- Developer: Cash Advance Apps

- E-Mail: android@maxloan.icu

- Website: Visit Small Loans Website

- 76.92% Contact Match

- Developer: Ursolov Nicolas

- E-Mail: reach-us-here@outlook.com

- Website: Visit Ursolov Nicolas Website

Deleting from Smartphone 📱

Delete on iPhone:

- On your homescreen, Tap and hold Small Loans for Bad Credit FFM until it starts shaking.

- Once it starts to shake, you'll see an X Mark at the top of the app icon.

- Click on that X to delete the Small Loans for Bad Credit FFM app.

Delete on Android:

- Open your GooglePlay app and goto the menu.

- Click "My Apps and Games" » then "Installed".

- Choose Small Loans for Bad Credit FFM, » then click "Uninstall".

Have a Problem with Small Loans for Bad Credit FFM? Report Issue

Reviews & Common Issues: 1 Comments

By Marquetta Chavez

2 years agoHow I get a loan

🎌 About Small Loans for Bad Credit FFM

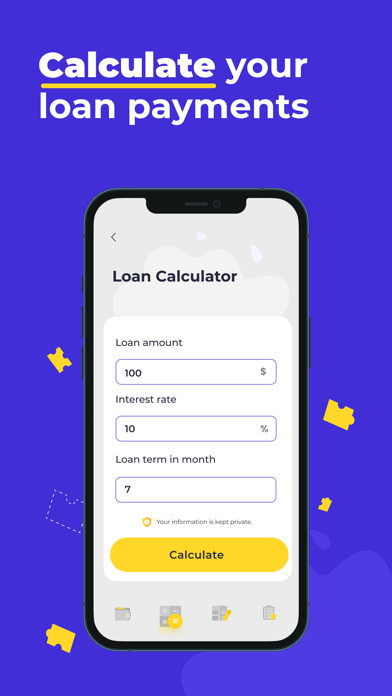

1. To obtain a loan, you need to provide your personal, financial, and labor information, while you give the lender for verification.

2. Every time you need financial support, our lenders can give you a quick loan for any need.

3. Now we will explain to you what APR (annual percentage rate) is - this is the interest rate that is charged when borrowing a payday loan.

4. But you can check our example of calculating the cost of a loan (based on: the loan amount is $1000.00, the loan term is 1 year, the APR is 6%).

5. Now you can borrow money wherever you are! Our loan app makes it possible to borrow money.

6. And the range of terms for repaying your loan is - from min 65 days to max 2 years.

7. Just apply from your smartphone and get our loan online.

8. Many turn to loans in these situations and it’s better to use this easy FFM App that could quickly solve your issues and reduce financial stress.

9. That is, in the end, you will pay - $1,032.80 for a loan.

10. If you have bad credit, watch out for online lenders that offer high-rate loans.

11. Our app is not a direct personal money lender.

12. However, the terms and conditions may change depending on the lender you are communicating with.

13. You don't need any funds for matching with service providers.

14. APR includes the interest rates and additional fees.