How to Delete Simple. save (84.67 MB)

Published by Simple FinanceWe have made it super easy to delete Simple - Mobile Banking account and/or app.

Table of Contents:

Guide to Delete Simple - Mobile Banking 👇

Things to note before removing Simple:

- The developer of Simple is Simple Finance and all inquiries must go to them.

- The GDPR gives EU and UK residents a "right to erasure" meaning that you can request app developers like Simple Finance to delete all your data it holds. Simple Finance must comply within 1 month.

- The CCPA lets American residents request that Simple Finance deletes your data or risk incurring a fine (upto $7,500 dollars).

↪️ Steps to delete Simple account:

1: Visit the Simple website directly Here →

2: Contact Simple Support/ Customer Service:

- 100% Contact Match

- Developer: SIMPLE Mobile

- E-Mail: android_administrator@simplemobilemail.com

- Website: Visit Simple Website

Deleting from Smartphone 📱

Delete on iPhone:

- On your homescreen, Tap and hold Simple - Mobile Banking until it starts shaking.

- Once it starts to shake, you'll see an X Mark at the top of the app icon.

- Click on that X to delete the Simple - Mobile Banking app.

Delete on Android:

- Open your GooglePlay app and goto the menu.

- Click "My Apps and Games" » then "Installed".

- Choose Simple - Mobile Banking, » then click "Uninstall".

Have a Problem with Simple - Mobile Banking? Report Issue

🎌 About Simple - Mobile Banking

1. Your tax refund is your money, and the IRS has been hanging onto it all year! So when you finally get it back, put it to work! Commit to saving a portion of your return before you even receive it, and when it hits your account, it’ll automatically transfer into your Protected Goals Account to build your savings and earn interest.

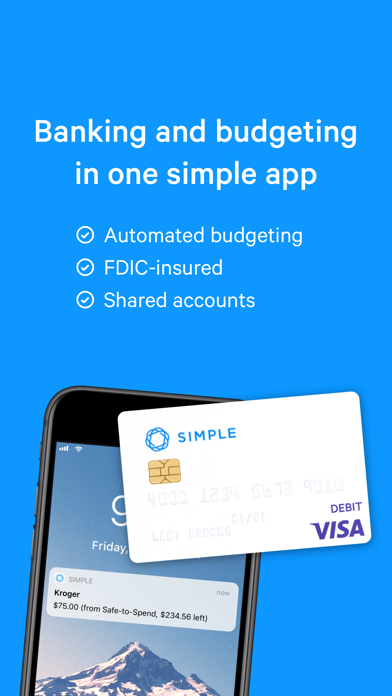

2. Earn interest with whoever you're interested in: When it comes to shared bills and savings goals, two paychecks are better than one! Open a Simple Shared account to tackle budgeting and save money together.

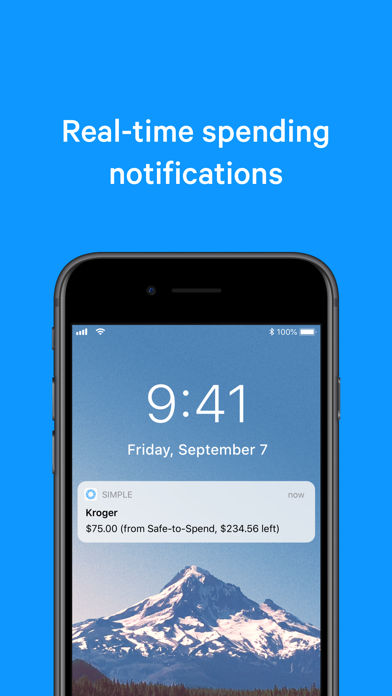

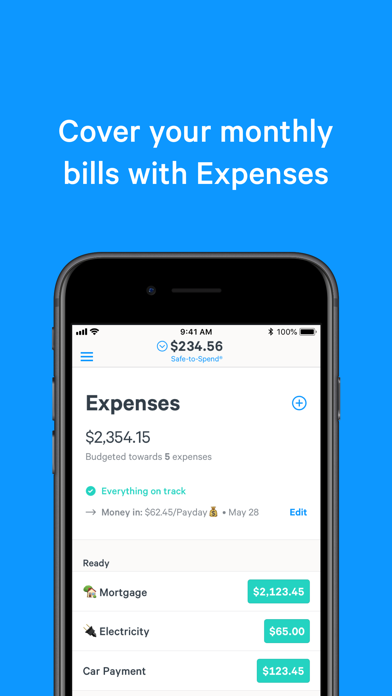

3. Spend money spontaneously, without derailing your budget or bills (or doing the math on the spot...). We take your account balance, subtract your Expenses and Goals, and tell you exactly how much money you have left over to spend on whatever you want.

4. Open a separate Protected Goals Account to keep money tucked away from spending while earning a competitive interest rate.

5. Every aspect of a Simple checking account is optimized for branchless online banking, budgeting, and saving, so you can track spending and manage your money wherever you happen to be.

6. Whenever you make a purchase, what you spend will be rounded up to the next whole dollar amount, and when those round-ups reach or exceed $5, that balance will be tucked away into your Protected Goals Account.

7. Budget and save with no hidden bank fees, with balances in Protected Goals Accounts earning a competitive interest rate.

8. Use Goals for saving money: Stash away money for the unexpected, or automate saving for things you want.

9. Put your savings to work for you! Simple’s No-Penalty CDs let you lock in a rate that guarantees growth for your savings—so you’ll know exactly how much your deposit will earn.

10. When you pay your rent, your Expense is already saving money for next month's bill.

11. Start saving money effortlessly with Round-up Rules.

12. It’s like a digital change jar...one that adds up to real money in the bank.

13. Simple is one of the first mobile banking apps that has helped customers budget and save since 2012.

14. The Simple Visa® Card is issued by BBVA USA pursuant to a license from Visa U.S.A. Inc.