How to Delete FBT. save (139.50 MB)

Published by First Bank and TrustWe have made it super easy to delete FBT Mobile Banking for Retail account and/or app.

Table of Contents:

Guide to Delete FBT Mobile Banking for Retail 👇

Things to note before removing FBT:

- The developer of FBT is First Bank and Trust and all inquiries must go to them.

- Check the Terms of Services and/or Privacy policy of First Bank and Trust to know if they support self-serve account deletion:

- The GDPR gives EU and UK residents a "right to erasure" meaning that you can request app developers like First Bank and Trust to delete all your data it holds. First Bank and Trust must comply within 1 month.

- The CCPA lets American residents request that First Bank and Trust deletes your data or risk incurring a fine (upto $7,500 dollars).

↪️ Steps to delete FBT account:

1: Visit the FBT website directly Here →

2: Contact FBT Support/ Customer Service:

- 100% Contact Match

- Developer: Farmers Bank & Trust (FB&T)

- E-Mail: support@farmersbankks.com

- Website: Visit FBT Website

- 100% Contact Match

- Developer: Flora Bank & Trust

- E-Mail: dev@fbandtbank.com

- Website: Visit Flora Bank & Trust Website

3: Check FBT's Terms/Privacy channels below for their data-deletion Email:

Deleting from Smartphone 📱

Delete on iPhone:

- On your homescreen, Tap and hold FBT Mobile Banking for Retail until it starts shaking.

- Once it starts to shake, you'll see an X Mark at the top of the app icon.

- Click on that X to delete the FBT Mobile Banking for Retail app.

Delete on Android:

- Open your GooglePlay app and goto the menu.

- Click "My Apps and Games" » then "Installed".

- Choose FBT Mobile Banking for Retail, » then click "Uninstall".

Have a Problem with FBT Mobile Banking for Retail? Report Issue

🎌 About FBT Mobile Banking for Retail

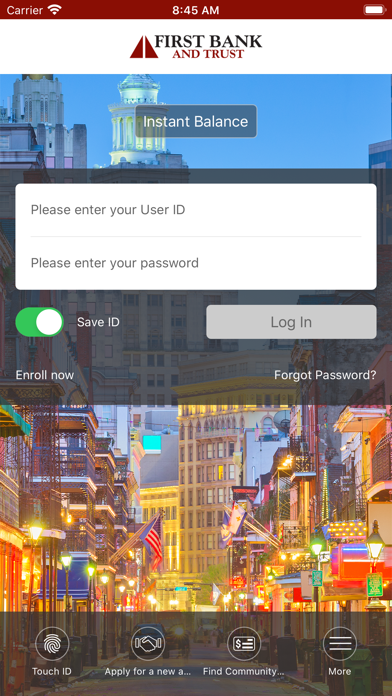

1. With an easy login process, you can monitor your account activity, check balances, transfer funds internally or to non-FBT accounts, pay bills, deposit checks, check account history, open new accounts and more.

2. The FBT Mobile App for retail customers gives you convenient and secure access 24x7 to your account information from your mobile devices.

3. Set alerts in Online Banking and turn on push notifications to alert you to important changes on your account like balance fluctuations, when checks clear, of upcoming bills and more.

4. Debit and credit card management is easy and all online through FBT Retail Mobile.

5. Disclosure: FBT does not charge for access to mobile banking.

6. Message and data rates may be charged by your mobile carrier service provider.

7. Find information on FBT locations and contact information.

8. For more information, please visit or call us at 504-584-5970.