Cancel Stash Subscription & Save $9.99/mth

Published by Stash on 2026-02-17Uncover the ways Stash (the company) bills you and cancel your Stash subscription.

🚨 Guide to Canceling Stash 👇

Note before cancelling:

- How easy is it to cancel Stash? It is Very Easy to Cancel a Stash subscription.

- The developer of Stash is Stash and all inquiries go to them.

- Check the Terms of Services and/or Privacy policy of Stash to know if they support self-serve subscription cancellation:

- Always cancel subscription 24 hours before it ends.

Your Potential Savings 💸

**Pricing data is based on average subscription prices reported by AppCutter.com users..

| Duration | Amount (USD) |

|---|---|

| One-time savings | $2.93 |

| Monthly savings | $9.99 |

🌐 Cancel directly via Stash

- 🌍 Contact Stash Support

- Mail Stash requesting that they cancel your account:

- E-Mail: support@stash.com

- Login to your Stash account.

- In the menu section, look for any of these: "Billing", "Subscription", "Payment", "Manage account", "Settings".

- Click the link, then follow the prompts to cancel your subscription.

End Stash subscription on iPhone/iPad:

- Goto Settings » ~Your name~ » "Subscriptions".

- Click Stash (subscription) » Cancel

Cancel subscription on Android:

- Goto Google PlayStore » Menu » "Subscriptions"

- Click on Stash: Investing made easy

- Click "Cancel Subscription".

💳 Cancel Stash on Paypal:

- Goto Paypal.com .

- Click "Settings" » "Payments" » "Manage Automatic Payments" (in Automatic Payments dashboard).

- You'll see a list of merchants you've subscribed to.

- Click on "Stash" or "Stash" to cancel.

Subscription Costs (Saved) 💰

- Stash Growth: $3/month

- Stash+: $9/month

Have a Problem with Stash: Investing made easy? Report Issue

About Stash: Investing made easy?

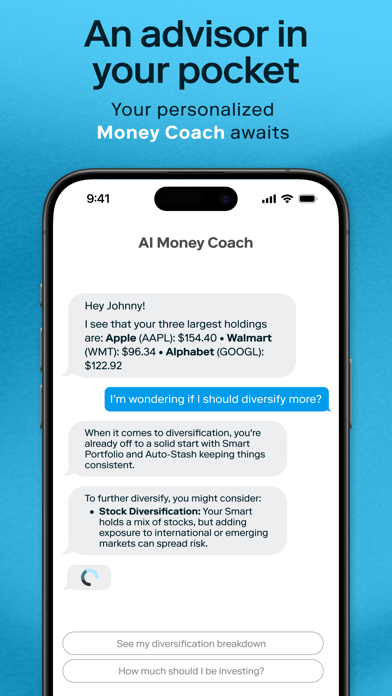

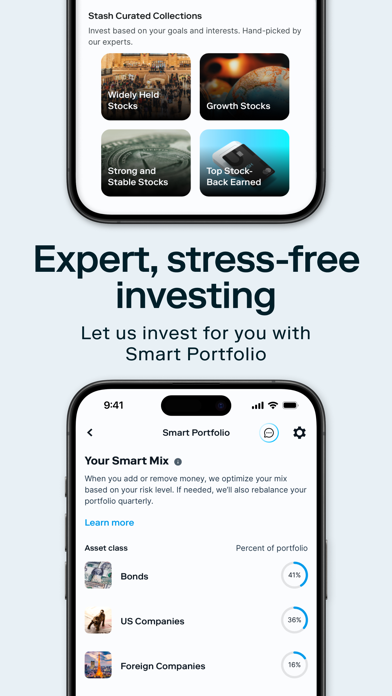

1. Stash is a mobile banking and investing app that makes it easy and affordable to invest in stocks, bonds, ETFs, and crypto for millions of Americans.

2. Bank Account Services provided by & Stash Visa Debit Card (Stock-Back® Card) issued by Green Dot Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc.

3. Investment products & services are offered by Stash Investments LLC, not Green Dot Bank, & are Not FDIC Insured, Not Bank Guaranteed, & May Lose Value.

4. You’ll bear the standard fees & expenses reflected in the pricing of ETFs in your investment account(s), plus fees for various ancillary services charged by Stash & the Custodian.

5. Preliminary information provided to prospective clients prior to Stash accepting a signed advisory agreement is not investment advice & should not be relied on as such.