Cancel OKCU Digital Banking Subscription

Published by Oklahoma Employees Credit Union on 2024-11-07Uncover the ways Oklahoma Employees Credit Union (the company) bills you and cancel your OKCU Digital Banking subscription.

🚨 Guide to Canceling OKCU Digital Banking 👇

Note before cancelling:

- The developer of OKCU Digital Banking is Oklahoma Employees Credit Union and all inquiries go to them.

- Check the Terms of Services and/or Privacy policy of Oklahoma Employees Credit Union to know if they support self-serve subscription cancellation:

- Always cancel subscription 24 hours before it ends.

🌐 Cancel directly via OKCU Digital Banking

- 🌍 Contact OKCU Digital Banking Support

- Mail OKCU Digital Banking requesting that they cancel your account:

- E-Mail: info@okcu.org

- Login to your OKCU Digital Banking account.

- In the menu section, look for any of these: "Billing", "Subscription", "Payment", "Manage account", "Settings".

- Click the link, then follow the prompts to cancel your subscription.

End OKCU Digital Banking subscription on iPhone/iPad:

- Goto Settings » ~Your name~ » "Subscriptions".

- Click OKCU Digital Banking (subscription) » Cancel

Cancel subscription on Android:

- Goto Google PlayStore » Menu » "Subscriptions"

- Click on OKCU Digital Banking

- Click "Cancel Subscription".

💳 Cancel OKCU Digital Banking on Paypal:

- Goto Paypal.com .

- Click "Settings" » "Payments" » "Manage Automatic Payments" (in Automatic Payments dashboard).

- You'll see a list of merchants you've subscribed to.

- Click on "OKCU Digital Banking" or "Oklahoma Employees Credit Union" to cancel.

Subscription Costs (Saved) 💰

Free

- Access to basic digital banking features such as checking balances, transferring funds, and paying bills.

[2] Premium

- $5/month

- Includes all features of the Free subscription plus:

- Enhanced security with temporary access codes

- Link accounts from other banks and credit unions

- Personalized views of accounts

- Text to chat customer support

- Account alerts customization

- Transfer between banks

- Text banking

- Stop payments

- Card swap

- Mobile deposit

Note: Pricing and features may vary depending on the financial institution and location.

Have a Problem with OKCU Digital Banking? Report Issue

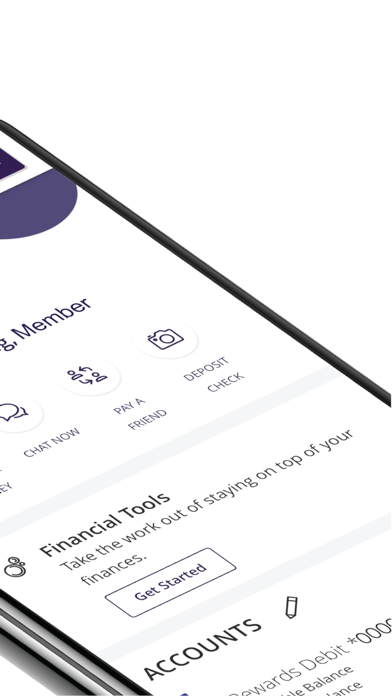

About OKCU Digital Banking?

1. • Link Accounts from other Banks and Credit Unions – View balances and transactions from any other bank or credit union on your OKCU Digital Banking homepage dashboard.

2. Have accounts with other banks or credit unions? You can now add accounts from other financial institutions to your OKCU Digital Banking app.

3. • Personalized Views – If you have more than one account with OKCU or add accounts from other banks or credit unions, you can customize which accounts appear on your home page, the order they appear and create nicknames.

4. • Card Swap – If your debit or credit card is compromised or you get a new card, you can enter the new card number in one place and it automatically updates your payment information for all subscriptions attached to the previous card.

5. • Transfer Between Banks – Add accounts from other financial institutions and make transfers to them.