Cancel MyBrightFi Subscription

Published by BrightFi LLCUncover the ways BrightFi LLC (the company) bills you and cancel your MyBrightFi subscription.

🚨 Guide to Canceling MyBrightFi 👇

Note before cancelling:

- The developer of MyBrightFi is BrightFi LLC and all inquiries go to them.

- Check BrightFi LLC's Terms of Services/Privacy policy if they support self-serve cancellation:

- Always cancel subscription 24 hours before it ends.

🌐 Cancel directly via MyBrightFi

- 🌍 Contact MyBrightFi Support

- Mail MyBrightFi requesting that they cancel your account:

- E-Mail: appsupport@bmtx.com

- Login to your MyBrightFi account.

- In the menu section, look for any of these: "Billing", "Subscription", "Payment", "Manage account", "Settings".

- Click the link, then follow the prompts to cancel your subscription.

End MyBrightFi subscription on iPhone/iPad:

- Goto Settings » ~Your name~ » "Subscriptions".

- Click MyBrightFi (subscription) » Cancel

Cancel subscription on Android:

- Goto Google PlayStore » Menu » "Subscriptions"

- Click on MyBrightFi Mobile

- Click "Cancel Subscription".

💳 Cancel MyBrightFi on Paypal:

- Goto Paypal.com .

- Click "Settings" » "Payments" » "Manage Automatic Payments" (in Automatic Payments dashboard).

- You'll see a list of merchants you've subscribed to.

- Click on "MyBrightFi" or "BrightFi LLC" to cancel.

Subscription Costs (Saved) 💰

- Monthly subscription of $4.95

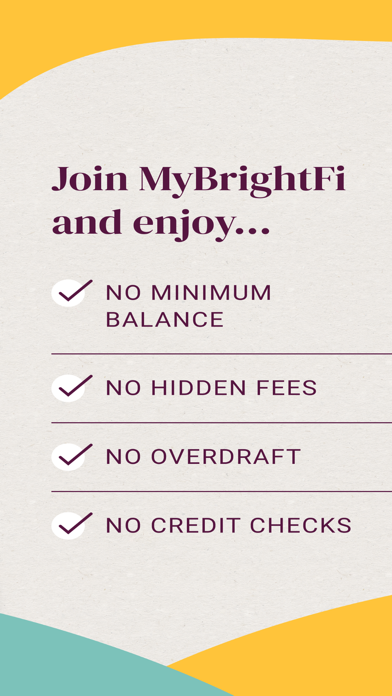

- No credit checks, minimum balances, or minimum funding amounts required

- Account for everyday spending with deposits held by Webster Bank, N.A., and FDIC-insured up to $250,000

- Mastercard Debit Card

- Mobile check deposit to avoid check cashers

- Savings Jars to put money aside for future expenses and goals

- Transfer money to friends and family at no extra cost

- BillPay features

- No overdraft fees

- Live customer service from Customer Support Specialists in English and Spanish

Have a Problem with MyBrightFi Mobile? Report Issue

About MyBrightFi Mobile?

1. Keep control of your money with technology and security features, immediate access to direct deposited funds, ways to save for your goals and the ability to send money to friends and family, all from the palm of your hand.

2. Banking services are provided by Webster Bank, N.A.; Member FDIC.

3. Banking services provided by Webster Bank, N.A., Member FDIC.

4. MyBrightFi is the banking app designed to help you keep more of your hard-earned money.

5. With no hidden fees, no overdrafts and no ATM fees*, our customers can save hundreds of dollars each year in fees.