How to Delete CA next bank mobile banking. save (41.21 MB)

Published by Credit Agricole (Suisse) SAWe have made it super easy to delete CA next bank mobile banking account and/or app.

Table of Contents:

Guide to Delete CA next bank mobile banking 👇

Things to note before removing CA next bank mobile banking:

- The developer of CA next bank mobile banking is Credit Agricole (Suisse) SA and all inquiries must go to them.

- The GDPR gives EU and UK residents a "right to erasure" meaning that you can request app developers like Credit Agricole (Suisse) SA to delete all your data it holds. Credit Agricole (Suisse) SA must comply within 1 month.

- The CCPA lets American residents request that Credit Agricole (Suisse) SA deletes your data or risk incurring a fine (upto $7,500 dollars).

↪️ Steps to delete CA next bank mobile banking account:

1: Visit the CA next bank mobile banking website directly Here →

2: Contact CA next bank mobile banking Support/ Customer Service:

- 50% Contact Match

- Developer: Century Next Bank

- E-Mail: bankofruston@gmail.com

- Website: Visit CA next bank mobile banking Website

Deleting from Smartphone 📱

Delete on iPhone:

- On your homescreen, Tap and hold CA next bank mobile banking until it starts shaking.

- Once it starts to shake, you'll see an X Mark at the top of the app icon.

- Click on that X to delete the CA next bank mobile banking app.

Delete on Android:

- Open your GooglePlay app and goto the menu.

- Click "My Apps and Games" » then "Installed".

- Choose CA next bank mobile banking, » then click "Uninstall".

Have a Problem with CA next bank mobile banking? Report Issue

🎌 About CA next bank mobile banking

1. Using the services of trusted third parties in order to download, run or connect to the application (App Store) constitutes agreement to the existence of a commercial relationship with Crédit Agricole next bank (Suisse) SA.

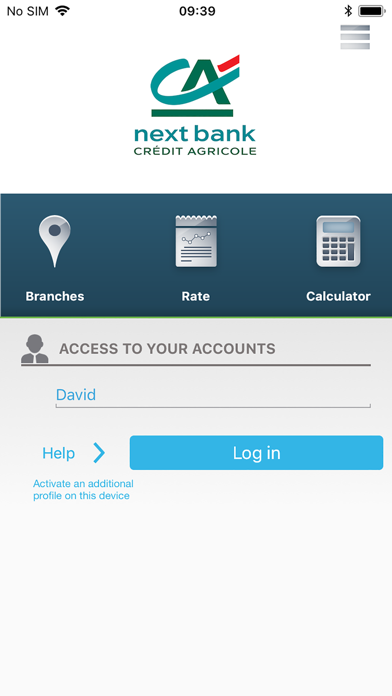

2. Even if you are not a Crédit Agricole next bank customer, you can still download the application in order to look for a branch or check today’s exchange rate, for example.

3. Crédit Agricole next bank (Suisse) SA cannot be held liable for any expenses incurred during downloading or use of the application in respect of the mobile operator.

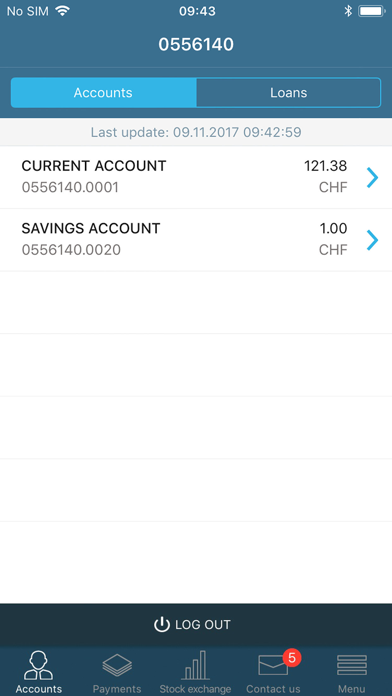

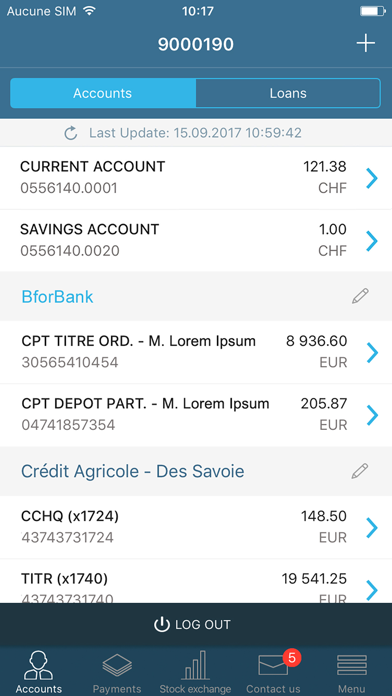

4. Thanks to its “mobile banking” application, Crédit Agricole next bank lets you manage your accounts using your smartphone wherever you are.

5. For these reasons, Crédit Agricole next bank (Suisse) SA can no longer guarantee banking secrecy if your banking relationship is divulged to a third party or if a device is lost or stolen.

6. Crédit Agricole next bank attaches tremendous importance to the security of your personal information and bank details.

7. - Protect your phone with a security password in order to restrict access to your personal information and applications.

8. The application gives you access to functions that make your life easier - it's completely secure and only takes a couple of clicks.

9. The “mobile banking” application is designed to keep your data as secure as possible when you are out and about.

10. You will need a computer, your smartphone and your e-banking access codes.

11. - You need to have accepted the “Conditions of use for the mobile application”.

12. - Avoid connecting to unsecured Wi-Fi (such as in stations and public spaces).

13. - You need to have accepted the “Conditions of use for e-banking” via your e-banking.

14. These are the application’s main functions, broken down into the two public and private browsing zones.